There is a dramatic and increasing shortage of housing in Fort Worth and across Texas. Up for Growth estimates that statewide Texas needs 322,000 more homes than are available. More than 85,000 of those homes are needed specifically in DFW. These estimates align to recent local reports that identify critical gaps for working families and low-income households on the order of 30,000-35,000 housing units in both Dallas and Fort Worth.

Population growth is fueling this housing market imbalance, particularly in Fort Worth, which is the fastest growing among the 30 most populous cities in the United States. In the past 3 years, Fort Worth has been adding nearly 20,000 people per year on average. However, based on building permit data, builders are only working to bring about 13,000 new units per year. Corporate buyers are also notably impacting demand in the Fort Worth area – they represented more than 50% of home purchases in 2021, which places Tarrant County third among the most populous counties for corporate housing transactions.[1]

Families that historically would have been ready and able to consider purchasing a starter home are staying longer in the rental market, which affects the supply and price of rental units. The median rent in Fort Worth for a 2-bedroom apartment is $1,357.[2] In order to afford that rent, a household would need to earn more than $55,000. More than 34% of Fort Worth’s population earns less than $50,000,[3] leaving this group with limited options for quality, affordable housing.

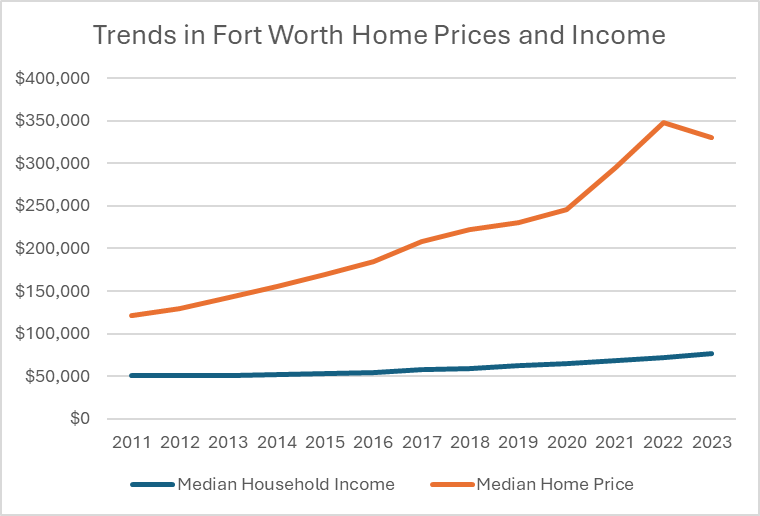

All homebuyers regardless of income are feeling the squeeze of surging demand and other market constraints, but this issue is amplified for families in lower income brackets. The median price to purchase a home in Fort Worth is $330,000 which is far out of reach for a family earning the median income of $77,082 who needs a home priced closer to $200,000. The income required to buy a home in Fort Worth has approximately doubled in the past decade, but income growth is nowhere near that pace (see chart below). While the median home price has finally begun to fall off, homeownership is still far out of reach for too many families.

Since 2011, the median home price has increased 173% while median household income has increased only 53%.

A shortage of attainably priced housing means that:

- Families pay an outsized portion of their income for housing costs, squeezing the remainder of their budget unsustainably and with a negative impact on their ability to meet basic needs, and

- Households that are interested to move to their next home are faced with extremely limited options in a highly competitive market, causing them to stay in place longer, compressing the housing market for all income brackets below them. This compression places upward pressure on rents, which can be a factor in causing some low-income residents to be priced out of housing altogether and enter into homelessness.

Existing resources and strategies are insufficient to address the current needs in the housing market, let alone the challenges we will face in the future with continued growth. In Fort Worth, there are currently 32,000 renter households who are cost-burdened, meaning they face rents that are unsustainable given their income level. As a point of reference, the city of Fort Worth assisted 838 households under the 2022-2023 HUD-funded action plan, addressing just 2.6% of the need. [4] From 2018 through 2022, the city added 32,819 new units of multifamily housing, but only 2,539 (<8%) were categorized as affordable.

It will be impossible to make a meaningful difference in the affordable housing shortage without innovation and additional resources from a variety of stakeholders. The state legislature is expected to resume discussions during the 2025 session on the topic of housing affordability. A number of potential policy tools could be deployed to increase housing supply, such as streamlining permitting and zoning procedures and adjusting the minimum lot size for single-family homes. In addition, It will be critical that stakeholders explore strategies that ensure the benefits of housing and economic development accrue to the community as a whole, paying attention to residents’ concerns about displacement and access to opportunity.

At the Rainwater Charitable Foundation, we recognize that housing affordability is often a primary barrier to accessing high-opportunity neighborhoods with access to quality schools, good jobs and other amenities. We are working to align our giving to help increase the stock of affordable housing and increase access to homeownership to help families stabilize and build generational wealth. We are actively exploring opportunities to leverage and layer diverse funding sources to bring more housing solutions to the market, and particularly to bring more investment to historically disenfranchised communities. We believe there are strong financial and ethical arguments that can be made to encourage investment in attainable housing. Stable housing is a key asset for families with far-reaching implications for financial, health, and other life outcomes. We look forward to collaborating with like-minded funders, public officials, and housing practitioners to increase access to housing.

To learn more about RCF’s partnerships with organizations to promote flourishing of Tarrant County families and children through quality education, upskilling, affordable housing, and childcare, please visit our website.

[1] National Association of Realtors, 2022

[2] https://www.apartmentlist.com/rent-report/tx/fort-worth

[3] US Census Bureau, American Community Survey 1-Year, 2022, Table S1901.

[4] https://www.fortworthtexas.gov/files/assets/public/v/1/neighborhoods/documents/reports2023/fortworthncpahp_book_forprint-2.pdf