Predatory lending practices, particularly payday and auto title loans, have long been a challenge for residents in Fort Worth and beyond. Traditional mass-market credit products operate under stricter regulations than alternative financing products. Thus, alternative products are much more costly to borrowers. In addition, people seeking alternative financing often encounter deceptive marketing for these products, which can lead to extended repayment cycles with compounding interest. In recent years, while payday loans appear to be declining, other financial products such as Earned Wage Access (EWA) apps have entered the market, raising new questions about consumer protection.

The State of Payday and Auto Title Lending in Fort Worth

Over the past five years, payday and auto title lenders have consistently charged fees and interest rates resulting in effective annual percentage rates (APR) that exceed 400%. Comparatively, credit card APR’s range from around 13% to 30%. Credit cards are primarily regulated at the federal level under uniform standards such as the Truth in Lending Act and the CARD Act, ensuring consistent disclosures like the Schumer Box. In contrast, payday loans are governed by a mix of federal and state laws, leading to variable disclosure requirements and consumer protections.

In 2023, according to the Texas Office of Consumer Credit Commissioner, payday and auto title lenders issued 59,891 new loans in the Fort Worth-Arlington MSA with a total loan volume of $205 million, of which a staggering $78 million (38%) were fees alone. On average, each loan issued had a principal and fee total of approximately $3,423.

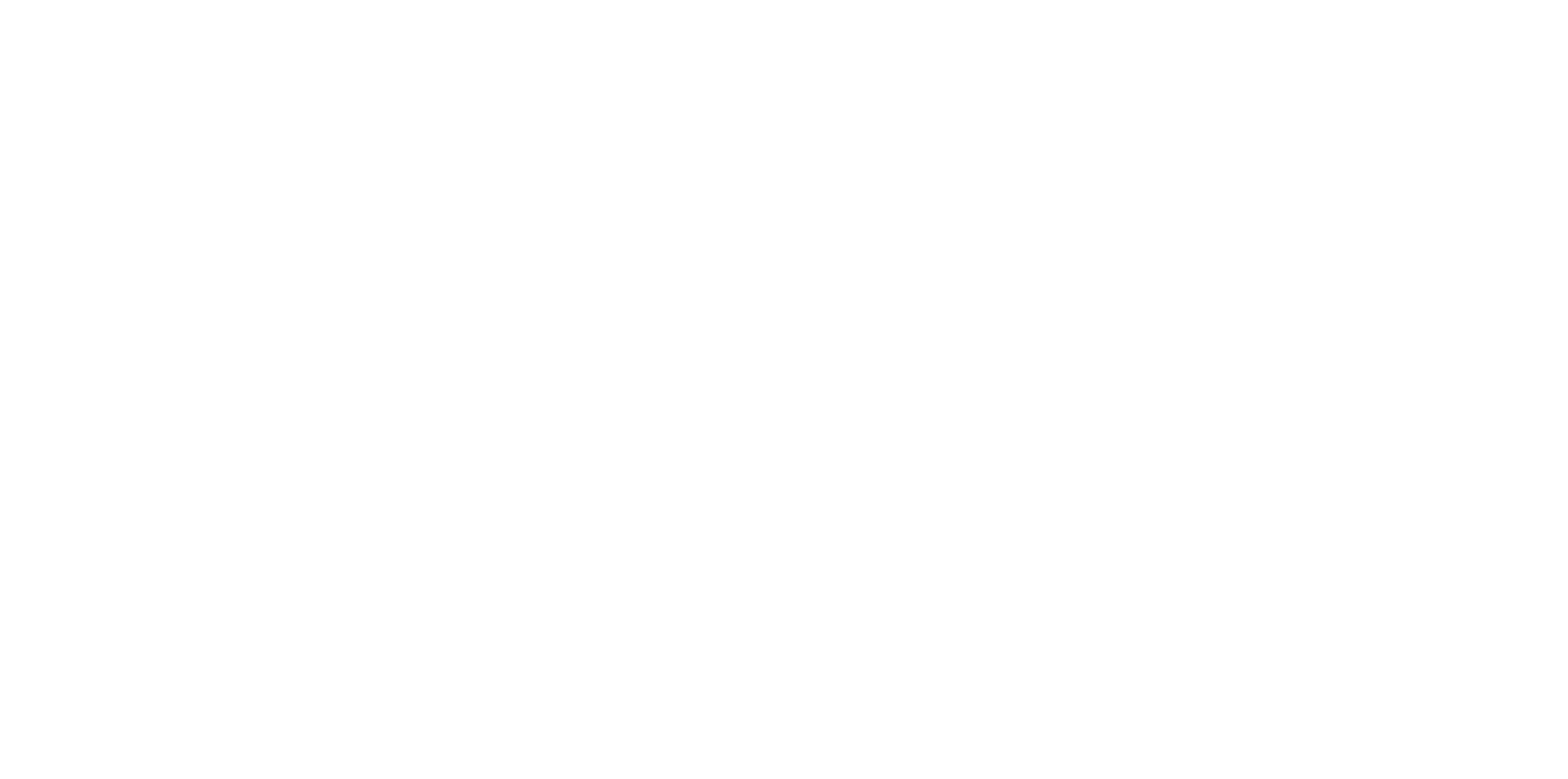

Auto title loans pose a severe risk to borrowers, as repossession rates climbed from 19% in 2019 to 30% in 2023. This means that nearly one in three borrowers lost their vehicles, often their primary means of transportation to work and school.

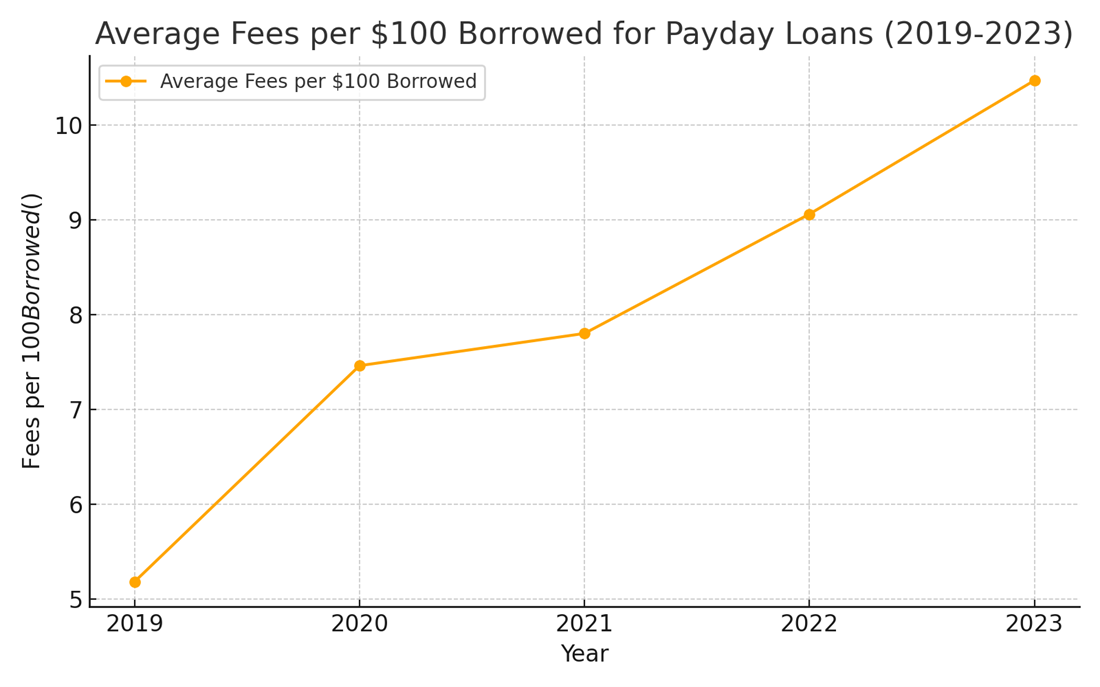

Cost to Borrow: The fees for payday loans have increased dramatically since 2019. In 2019, borrowers paid an average of $5.18 per $100 borrowed, but by 2023, this figure had risen to $10.47 per $100—a 102% increase

A Payday Loan Example: Borrowing $500 with Refinancing

To illustrate the cost of payday loans, consider a borrower who takes out a $500 loan with a 503% APR, a 22-day loan term, and average fees of $29.61 per $100 borrowed. If the borrower refinances 3 times, the costs escalate significantly:

- Original Loan: $500

- Total Fees from Refinancing: $601.07 (after average of 3 refinancing)

- Total Repayment After Refinancing: $1,101.07

Note: This calculation excludes additional late payment fees, which can further increase the cost of borrowing.

This scenario demonstrates how even a relatively small loan of $500 can result in substantial costs when refinanced multiple times, highlighting the financial strain these loans place on borrowers.

Historical Context: Payday Lending in Texas

Payday and auto title loans have a long and complex history in Texas, rooted in legislative loopholes that have allowed these industries to flourish.

- Legislative Challenges: In the 1990s, payday loans were largely illegal in Texas. However, lenders exploited a regulatory loophole to operate as “credit services organizations,” skirting existing caps on interest rates and fees. The city of Fort Worth, along with other cities in Texas, adopted additional commonsense local protections to help lower fees and decrease vehicle repossessions. A 2019 opinion by the Texas Attorney General interpreted state law in such a way compliance with these local ordinances is by and large optional now. By 2023, there were 87 storefront lenders in the Fort Worth-Arlington area.

- Borrower Demographics: Research by Pew Charitable Trusts found that payday loan borrowers are typically low-income individuals without access to traditional credit. Borrowers often take out these loans to cover recurring expenses, not unexpected emergencies, which exacerbate their financial challenges.

- Loan Persistence: According to the Consumer Financial Protection Bureau (CFPB), most payday borrowers roll over their loans or take out new ones shortly after repayment. In fact, the majority of payday loan borrowers are trapped in debt cycles, with refinances accounting for a significant portion of loan transactions.

Earned Wage Access (EWA) Products: A New Trend

The decline in payday loan fees may partially reflect the growth of Earned Wage Access (EWA) products, which allow workers to access wages before payday. While marketed as a safer alternative, EWA apps are not without risks.

- Hidden Costs: Some direct-to-consumer models charge fees that translate into APRs exceeding 100%, burdening users with high costs over time.

- Regulatory Concerns: Many EWA providers bypass traditional lending laws by classifying their products as ‘non-loans,’ which limits oversight. For example, a 2024 FTC case against the EWA app “Dave” revealed undisclosed fees and deceptive practices.

A Call to Action

Stable, affordable financial solutions are critical for families to catch up, get ahead, and ultimately thrive. Opportunities to support working families more effectively include:

Strengthen Regulations and Enforcement

- Implement stricter laws: Establish clear limits on interest rates and fees, such as capping annual percentage rates (APRs) for payday loans.

- Increase oversight: Strengthen the role of regulatory agencies, like the Consumer Financial Protection Bureau (CFPB), to monitor and penalize lenders engaging in predatory practices.

- Enhance transparency: Require lenders to clearly disclose all loan terms, including interest rates, fees, and repayment schedules, in plain language.

Expand Access to Affordable Credit

- Promote community banks and credit unions: These institutions often offer small-dollar loans with fair terms tailored to low-income borrowers.

- Encourage alternative loan programs: Support nonprofit lenders or employer-sponsored loan programs that provide affordable credit without predatory terms.

- Subsidize financial products: Governments or philanthropic organizations can help subsidize or guarantee loans for underserved populations.

Increase Financial Literacy and Awareness

- Educational campaigns: Launch programs to teach individuals how to identify predatory practices, evaluate loan terms, and avoid risky financial decisions.

- Community outreach: Partner with local organizations to reach vulnerable populations and provide workshops on budgeting and borrowing.

- Promote reporting channels: Ensure borrowers know where and how to report abusive practices to regulatory authorities or consumer advocacy groups.

We invite policymakers, nonprofits, and community members to join us in addressing predatory lending and ensuring that all Fort Worth residents have the financial resources to succeed. To get the latest blogs and updates on all the areas we serve, sign up for our RCF newsletter.